san francisco sales tax rate 2018

This is the total of state county and city sales tax rates. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the.

Tired Of Paying A Big Tax To Leave Britain Here S How To Skip It The New York Times

San Francisco 8625.

. Arrowbear Lake 7750 San Bernardino Arrowhead Highlands 7750 San Bernardino Arroyo Grande 7750 San Luis Obispo Artesia 9500 Los Angeles Artois 7250 Glenn Arvin. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt. The Basics of California State Sales Tax.

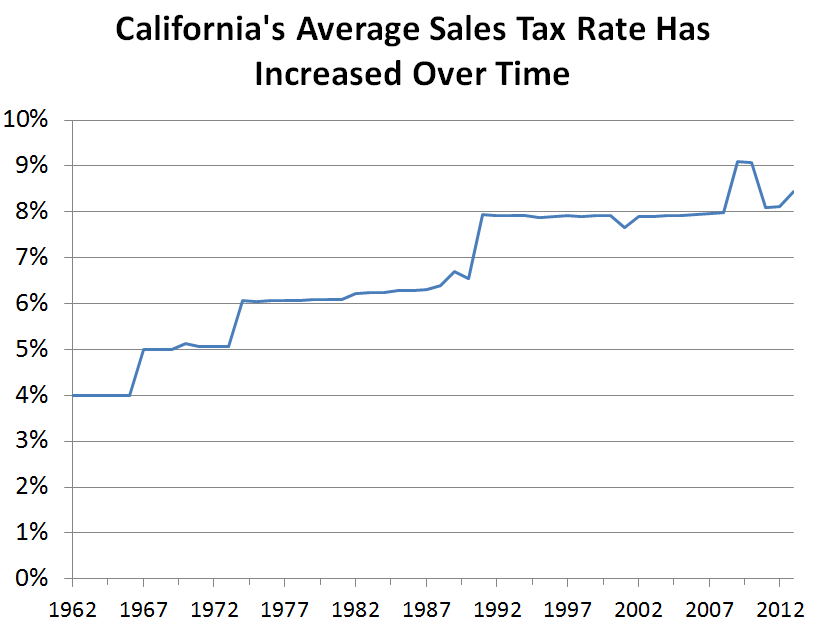

Tax will continue rather than be phased out after 2018. Historical Tax Rates in California Cities Counties. The California sales tax rate is currently.

A measure to increase and expand the scope of the local marijuana business tax was on the ballot for San Francisco voters in San Francisco County California on November 6. For business activities other than retail sales the rate would be 1 percent of gross receipts up to 1 million and 15 percent of gross receipts above 1 million. This is the total of state county and city sales tax rates.

San Francisco CA Sales Tax Rate. The minimum combined 2022 sales tax rate for San Francisco California is. San Gabriel CA Sales Tax Rate.

California sales tax rate. The California state sales tax rate is currently. A yes vote was a vote in favor of enacting a.

The South San Francisco California sales tax rate of 9875 applies to the following two zip codes. The new rates would go into. This rate is made up of 600 state sales tax rate and an.

What is the sales tax rate in San Francisco Colorado. This is the total of state county and city sales tax. The 2018 United States Supreme Court decision in South Dakota v.

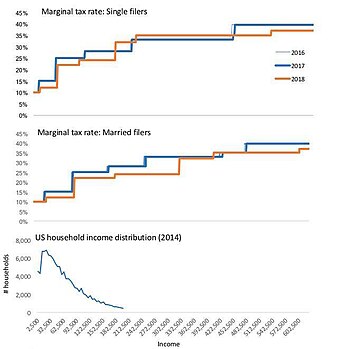

The California sales tax rate is currently. The San Francisco County sales tax rate is. Sales and Use Tax Rate through 12-31-16 Sales and Use Tax Rate as of 1-1-17 Gasoline Motor Vehicle Fuel 225.

San Geronimo CA Sales Tax Rate. The minimum combined 2022 sales tax rate for South San Francisco California is. The San Francisco Office of the Controller City and County of San Francisco.

The statewide California sales tax rate is 725. A county-wide sales tax rate of 025 is. It was approved.

San Francisco payroll expense tax rate for 2018 released. An alternative sales tax rate of 9875 applies in the tax region Daly. 5 rows The San Francisco County Sales Tax is 025.

San Fernando CA Sales Tax Rate. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. The minimum combined 2022 sales tax rate for San Francisco Colorado is 39.

A sales tax measure was on the ballot for Pasadena voters in Los Angeles County California on November 6 2018.

Which States Have The Highest Income Tax Rates Fedsmith Com

California S Sales Tax Rate Has Grown Over Time Econtax Blog

Tax Guide Best City To Buy Legal Weed In California Leafly

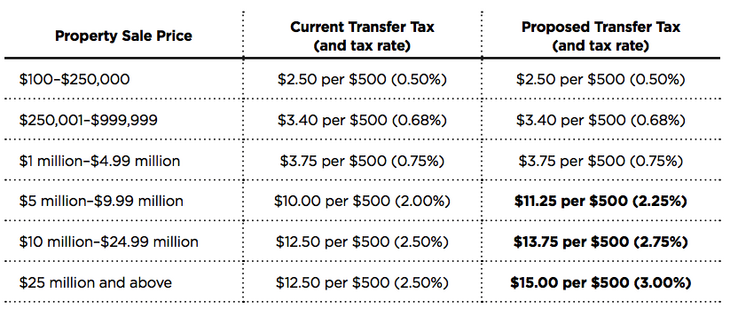

How The Tax Code Rewrite Favors Real Estate Over Art The New York Times

Short Term And Long Term Capital Gains Tax Rates By Income

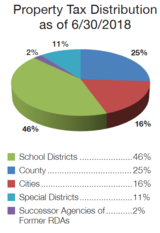

U S Cities With The Highest Property Taxes

Charts Of The Week Government Reform Municipal Taxes And Teacher Diversity Across The Us

San Francisco Prop W Transfer Tax Spur

State And Local Sales Tax Rates July 2018 Tax Foundation

State And Local Sales Tax Rates Sales Taxes Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

What S This S F Mandates Surcharge Doing On My Restaurant Check An Explainer

Primary Market Disclosure Final Official Statements San Francisco

![]()

Sales Tax In California Ballotpedia

Secured Property Taxes Treasurer Tax Collector

Where Do My Taxes Go County Of San Mateo Ca

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation